This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Business News Digital Labels & Publishers Top Stories

Indie sector report hones in on market share definitions

By Chris Cooke | Published on Monday 6 June 2016

The Worldwide Independent Network published a new report reviewing the indie label sector in 2016 at MIDEM on Friday, with the headline figures all relating to a common gripe among the independents, how market share figures are calculated in the recorded music market.

In the streaming age, record industry market share figures are about much more than mere bragging rights for any label whose share is up, because market share stats have an impact on the deals done between the rights owners and the streaming services, especially when it comes to things like the equity offered by start-ups to the labels.

As the boss of indie label digital rights agency Merlin, Charles Caldas, told CMU last year: “It seems to me that when those first [streaming service] conversations take place, the majors present market share figures based on the record industry at large, even though these are start-ups operating in the streaming music market”.

“And, as we’ve shown, if you take just the streaming music market, the indies come out with a bigger share. The majors can also skew the figures by including sales of the indie labels they distribute through their label services businesses, even though the long-term rights to distribute that content are often far from assured”.

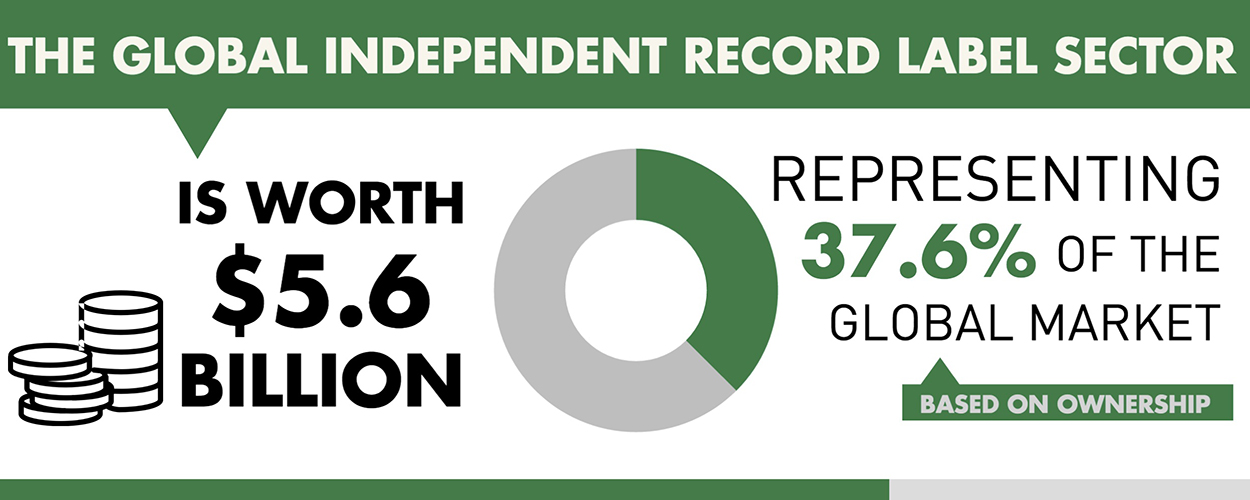

The so called new WINTEL report – produced for WIN by MIDiA Research and Warwick University – deals with both of these points, first arguing that indie labels represent 37.6% of the global recorded music market when music distributed by the majors but controlled by the indies is allocated to the latter rather than the former.

WIN says: “The report focuses on the criterion of value ‘based on rights ownership’ when analysing market share. This is an important distinction because where independent companies use major labels in various territories around the world to distribute their music, the major labels include the value of revenues derived from the distribution of independently owned rights into the label’s assessment of the majors’ own market share”.

Many indie labels rely on third party distributors to assure global reach, of course, with the report reckoning that 72% of independents make use of international distributors, 52% relying on a major’s distribution unit, or a distributor owned by a major like The Orchard.

Reaffirming Caldas’s point, WIN adds: “WINTEL’s analysis by reference to rights ownership provides a much more accurate overview of the marketplace. It is also important because market share is used by the leading digital music companies such as Apple, Google and Spotify in negotiations with the independent sector and often determines the levels of remuneration paid by these companies to music right holders”.

The indie sector’s market share varies greatly from territory to territory, of course, with WIN’s report reckoning that the while the indies command just 16% of the market in Finland, they represent 88% of the market in South Korea. Also backing up Caldas’s earlier remark, the report then claims that “in virtually every country, independent labels have significantly higher market share in streaming than they do in physical formats”.

In fact, WINTEL brags, “independent record labels have built sustainable businesses in the digital era. With an average roster of 40 artists each, they provide a crucial platform for artists that do not fit the major label ‘mainstream model’ yet have built broad audiences beyond ‘DIY’ platforms, locally and internationally”.

Commenting on the new research, which is accessible at winformusic.org, the boss of the global indie label-repping group, Alison Wenham, told reporters: “This is an important report, giving us the first truly global overview of the economic and cultural value of independent music. With a 37.6% market share based on rights ownership, and a contribution of $5.6 billion, it is clear that the independent music community is playing an increasingly important part within the global music industry”.

She went on: “Quite apart from the significance of the independent sector’s real market share, the vital contribution to the creation of local music in countries around the world assures that the cultural value and contribution of music is in very good hands with the independent sector”.

Meanwhile, the boss of pan-European indie labels group IMPALA, Helen Smith, added: “Having a single report covering key territories in Europe and across the world is vital for mapping the sector. There are three key takeaways”.

“First, each market has its own specificities, but developing local artists and helping them break borders is a primary focus of the independent sector across the world. Second, the independents are key players in the digital music market. Third, if ever there was an incentive for online services to play fair and pay fair, this report lays it out. In a nutshell, the independents are the most valuable part of the music market”.