This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Artist News Business News Labels & Publishers Legal

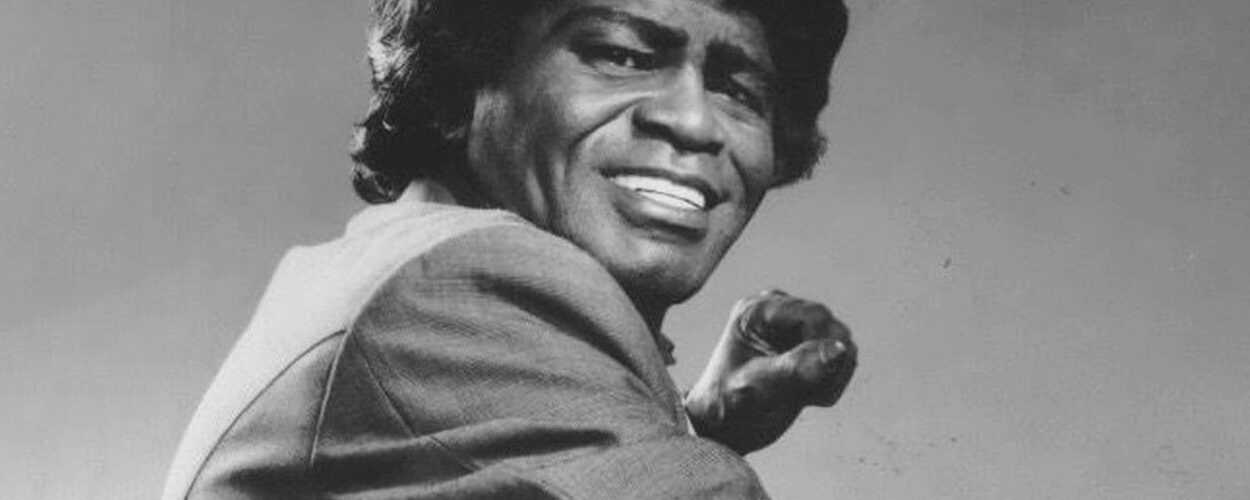

James Brown estate and Primary Wave sued by Bowie Bonds creator

By Chris Cooke | Published on Thursday 17 November 2022

The James Brown estate and Primary Wave have been sued by an entity called The Pullman Group over the big deal that was announced last year around the late musician’s song rights, recording royalties and brand.

Primary Wave announced its deal with the Brown estate last December. It saw the music rights firm acquire a stake in the James Brown songs catalogue, as well as securing involvement in the musician’s recording royalties, plus Brown’s name and likeness rights. But, claims The Pullman Group, that deal should not have gone ahead without its involvement.

The Pullman Group is headed up by David Pullman, who all the way back in the 1990s was doing deals with musicians around their music rights and royalties. Basically, Pullman’s investors paid artists a big upfront sum of money in return for control of their future royalties.

So, it was the 1990s version of the recent trend of investors buying up music copyrights and royalty rights from premiere league artists and songwriters who are eager for a big old upfront pay day. Pullman’s best known deal was with David Bowie, resulting in his music right investment products being dubbed Bowie Bonds.

Another artist who did a deal with Pullman in the 1990s was James Brown. According to a new legal filing, in 1999 Brown and his company James Brown Enterprises approached Pullman about doing a Bowie Bond style deal in a bid to get the musician’s finances under control.

Despite his success in the music industry, the lawsuit says, “Brown faced financial difficulties due to his exorbitant spending and myriad legal problems and liens, including a multi-million dollar federal tax debt, which led the [US tax authority] to seize Brown’s Beech Island, South Carolina property in 1985”.

A deal was done which “led to The Pullman Group securitising Brown’s assets”. To reduce Brown’s upfront costs, The Pullman Group waived the upfront fees it would usually have charged, meaning it would only get paid if and when the project was a success.

“In exchange for taking on the risk that the transaction would not be successful”, the lawsuit goes on, “The Pullman Group negotiated for and received valuable exclusive future rights” from Brown and his company. That included “exclusive rights regarding financial transactions related to James Brown’s assets, including the right to arrange any future refinancing or asset sales”.

Those extra rights would stay in place for 60 years, so until 2059, the lawsuit then claims. Which means that they were still very much in force when the Brown estate negotiated its big deal with Primary Wave.

“On or about 13 Dec 2021”, the lawsuit continues, “The Pullman Group learned for the first time when The New York Times broke the story that the Brown defendants, secretly and behind The Pullman Group’s back, had sold Brown’s assets – ‘including music rights’ – to Primary Wave, ‘a New York company that specialises in marketing estates and song catalogues’ in a deal ‘estimated at about $90 million'”.

That deal, The Pullman Group argues, violates its “exclusive rights regarding financial transactions related to James Brown’s assets”. Which means, it alleges, that the Brown estate is in breach of contact, while Primary Wave and its agents are accused of ‘tortious interference with a contract’.

As a result of all that, The Pullman Group would like lots of damages. Like, lots and lots of damages. We’re talking $11 million from the Brown estate and $125 million from Primary Wave. Perhaps unsurprisingly, the estate has told Billboard that Pullman’s lawsuit “has no merit” and that it intends “to vigorously defend the action”.