On Thursday Hipgnosis Songs Fund revealed that it would be advising shareholders to accept an offer of $1.16 per share from Concord to buy SONG.

At the time, CMU said “As things stand - bar a last minute bid from HSM-associated Blackstone - it seems likely that the deal with Concord will go through.”

Predictably enough, that last minute bid from Blackstone has now come good.

In a statement issued today - in a document, perhaps somewhat tellingly, titled PROJECT ECLIPSE - Blackstone says that it has made “a series of proposals” to acquire Hipgnosis Songs Fund and has today made “an improved fourth proposal” to acquire the full share capital of SONG for $1.24 a share - a premium of nearly 7% over Concord's $1.16 a share offer.

What Blackstone's statement says

In the statement, Blackstone says that it “strongly encourages” SONG's board to work with it to “reach agreement on a unanimously recommended firm offer in an expeditious manner”.

The press release goes on to point out that Hipgnosis Song Management, the Merck Mercuriadis-led (but majority Blackstone-owned) investment adviser to SONG, holds a 'call option' which allows it to buy the entire portfolio of songs held by the fund.

If the SONG board decides to go with Concord's lower offer Blackstone has made it clear that it “and its portfolio company HSM” have consulted law firm Kirkland & Ellis and, “having taken extensive legal advice, remain confident in the enforceability” of the call option.

As with many soberly worded corporate finance statements, there's a significant threat hidden at the end. If the SONG board doesn't agree to sell to Blackstone, or doesn't agree that the call option is valid, then Blackstone says it will “vigorously defend” the ”contractual protections” that HSM has under its contract with SONG. In simple terms: we'll see you in court.

Blackstone might use a "scheme of arrangement" to get control

The announcement also hints - perhaps somewhat surprisingly - that Blackstone anticipates that its higher offer may not be palatable to all shareholders. While today's announcement “does not constitute an announcement of a firm intention to make an offer” for SONG - which is basically a hedging statement under City regulations - Blackstone says that if it does decide to proceed with a firm offer then it would not hesitate to use company law to force the deal through. This would be done by using its rights under the takeover code to “implement any such firm offer by way of a scheme of arrangement under Part 26 of the Companies Act 2006”.

Typically in a takeover scenario the acquirer looks to secure at least 90% of the equity in the company it is acquiring, which allows it to implement a 'squeeze-out' that forces any hold-out shareholders to sell their shares at the offer price. Under a scheme of arrangement the bidder only needs to get agreement from 75% of shareholders, and can then get a court to approve its offer - asking that court to rule on the legality of the bid, but also to confirm that it is fair for the shareholders who have not agreed to the offer.

If the court approves the offer then it becomes binding on all shareholders, and the acquisition is completed. Alongside this it has other potential benefits. As a court-sanctioned move, a scheme of arrangement can be perceived as giving a deal greater legitimacy, and pre-empting any shareholder grumblings about unfair play. Additionally, by potentially setting a lower threshold for approval - 75% of shareholders vs 90% - a squeeze-out can sometimes be implemented faster - or against the wishes of some hold-out shareholders - which may have benefits in complex transactions.

What happens next?

Whether there will be further developments over the weekend remains to be seen - but it's beginning to look like the Hipgnosis drama may reach entirely new heights in coming weeks, as a Concord vs Blackstone battle for control plays out. With Universal Music sitting on a rights acquisition war chest via its recent deal that saw it buy KKR's stake in Chord (in which transaction, interestingly, it was also advised by Kirkland & Ellis), and Bertelsmann's CEO hinting that KKR-backed BMG may be open to “joining forces with a competitor” things could get very interesting.

UPDATE 20 Apr 2024, 7.15pm:

Concord's "irrevocable" commitments from shareholders

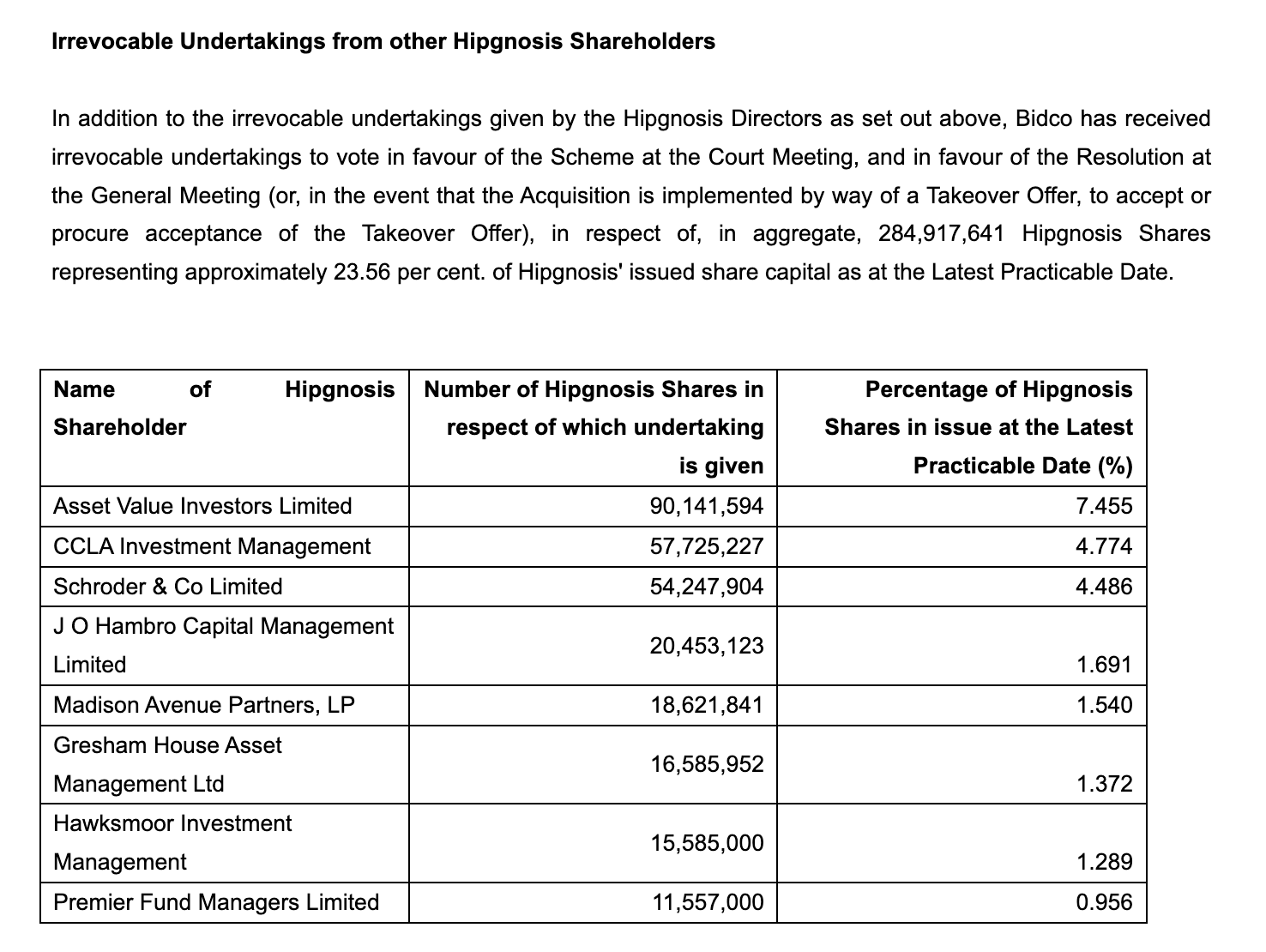

After revisiting the RNS statement issued on Thursday regarding Concord's offer for Hipgnosis, it's interesting to note that although there are irrevocable commitments relating to Concords offer that equate to 23.59% of the total issued shares, these irrevocable commitments are subject to 'fall-away provisions' making them irrevocable - but conditional. In other words, although the commitment is stated to be irrevocable, that irrevocability is not baked in stone.

This is of particular relevance given Blackstone's explicit reference to a "scheme of arrangement" which requires participation of only 75% of shareholders. Although Concord only had irrevocable commitments from 23.59% of shareholders, it had a letter of intent from Investec giving its bid effective control of a further 70 million shares, or 5.79% of the fund, bringing its total potential control to 29.38%.

However, they've now lost 1.54% of those irrevocable commitments, and given Investec's letter of intent is non-binding, Concord's bid suddenly looks less certain. At worst, their bid only controls 22.05% of the SONG shares - and could potentially end up with none.

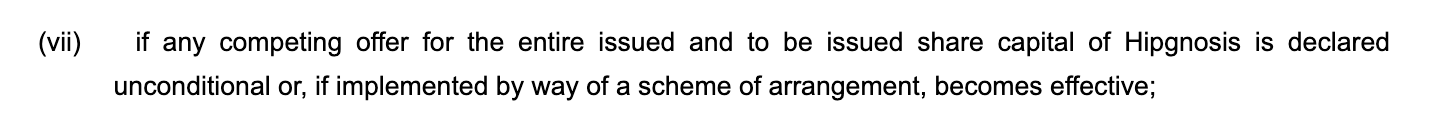

In particular, the irrevocable undertakings will “cease to bind” if “any competing offer for the entire issued and to be issued share capital of Hipgnosis is declared unconditional or, if implemented by way of a scheme of arrangement, becomes effective”.

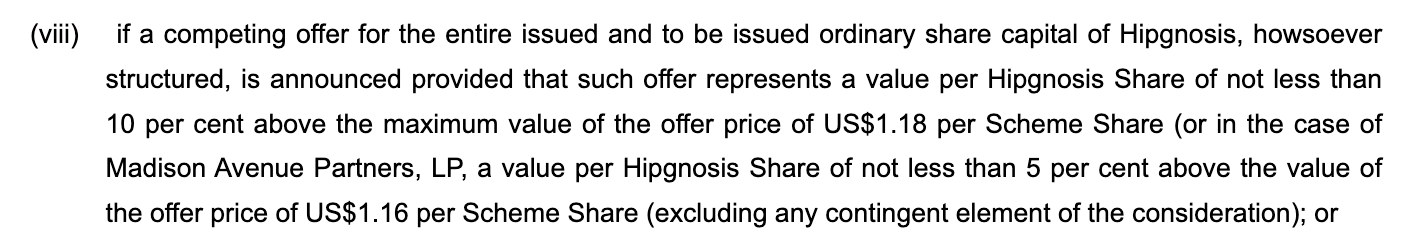

Additionally, if a competing offer “represents a value per Hipgnosis share of not less than 10 per cent above the “maximum value” of Concord's offer price of $1.18 per share then the fall-away provision comes into effect. Although Concord's offer is $1.16 per share, the $1.18 “maximum value” includes the so-called 'FO clause' that makes an additional $25 million available as a disbursement to shareholders - equating to 2 cents per share - if HSM agrees to terminate its investment advisory contract.

As previously noted, of more concern to SONG at this point is the fall-away provision inserted by Madison Avenue Partners LP, which holds 18.62 million shares, of 1.54% of the stock. If Blackstone makes a firm bid then this means that this irrevocable commitment would be subject to that fall-away provision, meaning Concord would then only have irrevocable commitments over 22.05% of the issued shares.

Significant trading volumes in Hipgnosis stock

However, with around 303 million shares changing hands on Thursday and Friday, the calculus of this offer may well have changed with investors potentially snapping up additional shares - or entirely new holdings - to take advantage of the market chaos now surrounding SONG.

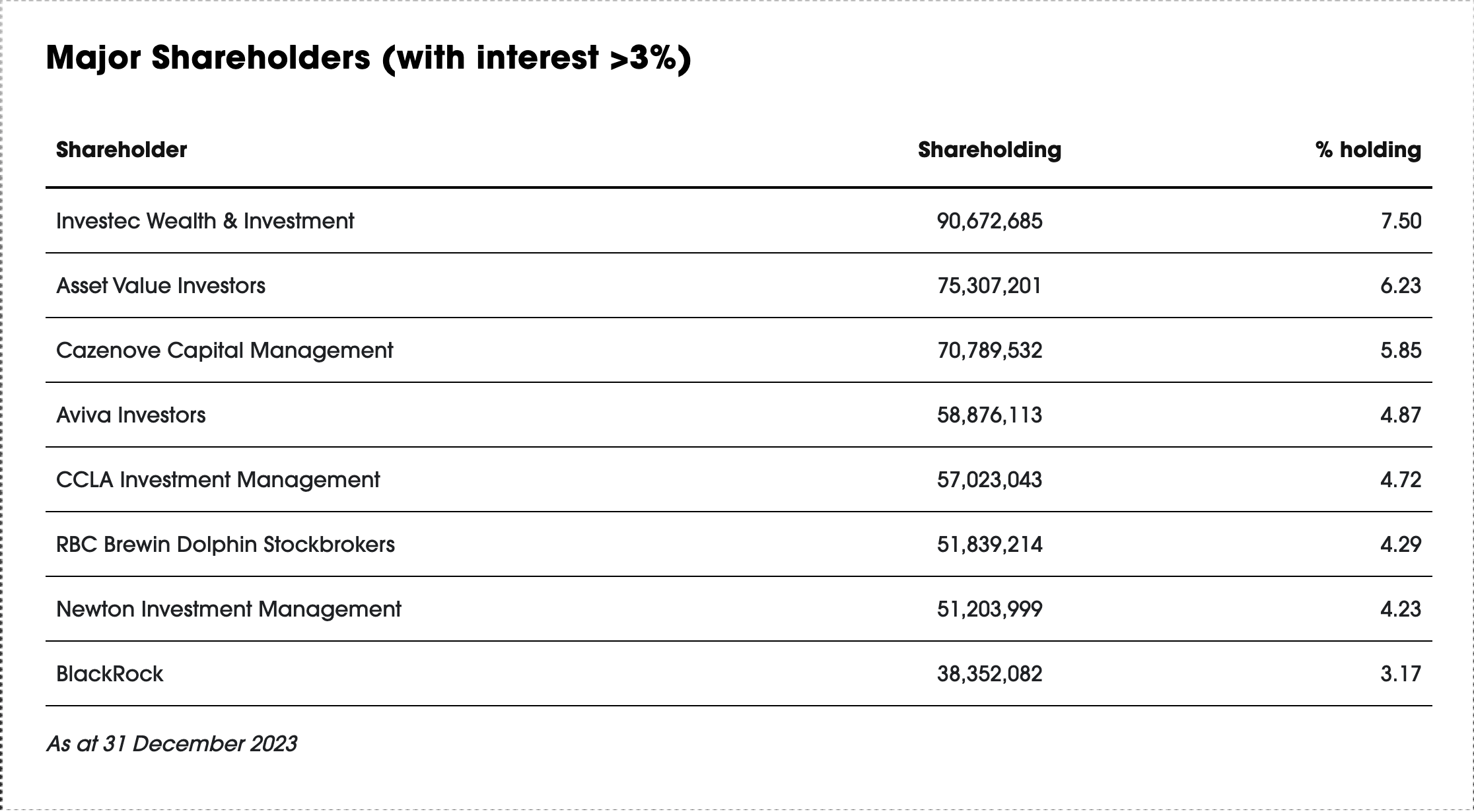

Compare these irrevocable undertakings to the 'major shareholders' table published by SONG as of December 2023. Asset Value Investors has - in the 108 days between 31 Dec 2023 and 17 Apr 2024 (the day before Concord's offer was made public) - increased its shareholding in SONG by at least 14.8 million shares, potentially investing around £10 million to increase its holding.

It's also worth noting that Schroders - stated to be in control of 54.2 million shares, or 4.49% of the fund - had a shareholding of less than 3% on 31 Dec.