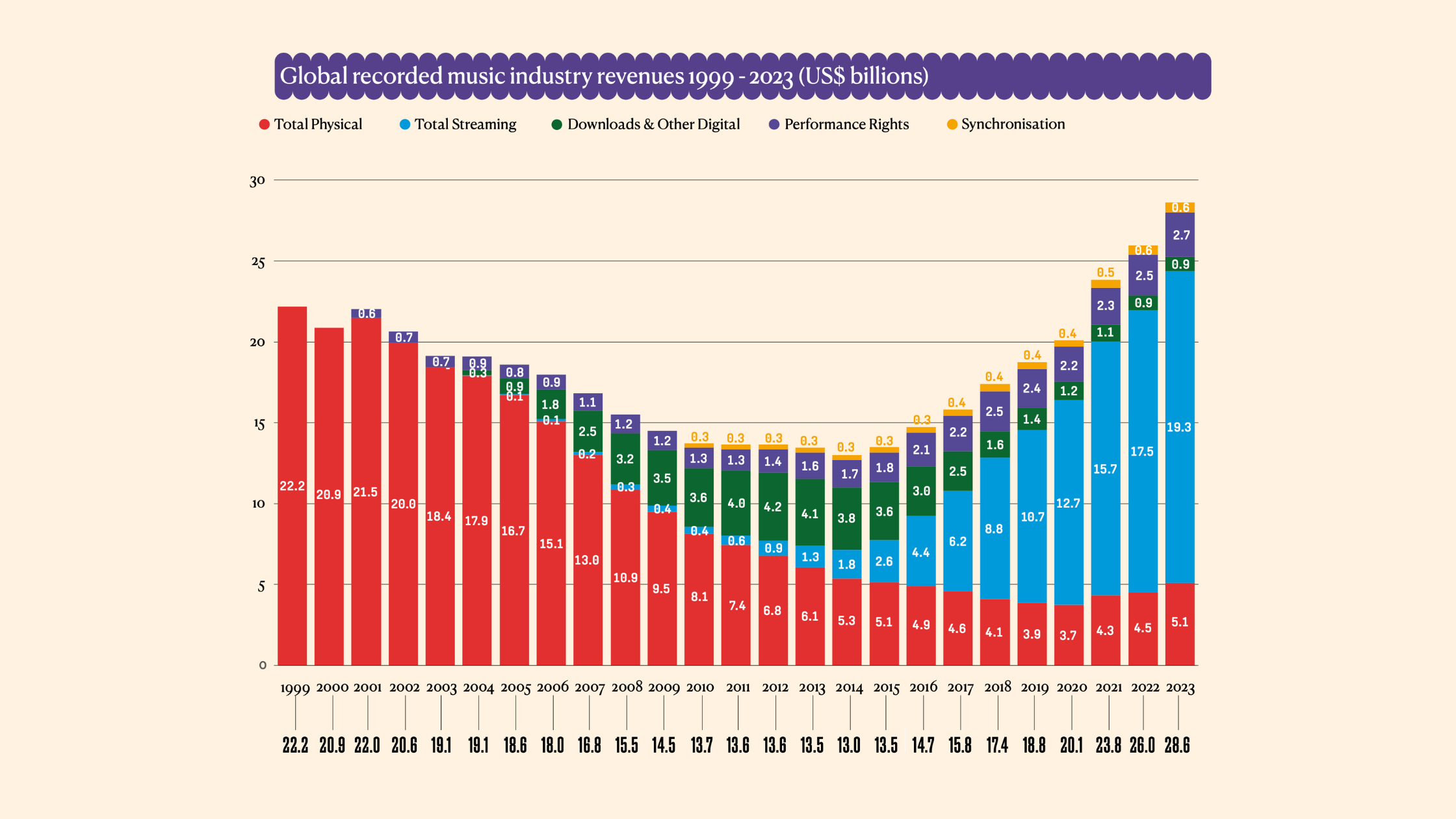

The International Federation Of The Phonographic Industry has published its annual Global Music Report, capturing stats from recorded music markets across the world. By its maths, global recorded music revenues grew by 10.2% last year to $28.6 billion, another all time high, providing nobody adjusts the revenues generated during the peak of the CD era for inflation.

Streaming continues to power much of the growth, with total streaming income - from both premium and ad-funded services - up 10.4%. In a year when premium subscription prices finally started to increase, subscription streaming revenues specifically were up 11.2%.

That said, growth rates were actually higher in physical product sales, which were up 13.4%, partly because of the vinyl revival, but also due to what IFPI calls "strong gains" in CD revenues. As a result, physical accounted for a higher portion of total revenues in 2023 compared to 2022, although only just - 17.8% as opposed to 17.5%.

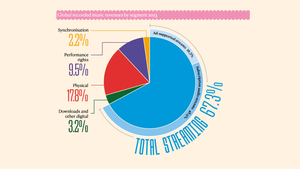

According to IFPI's figures, streaming accounted for 67.3% of total revenues in 2023, broadcast and performance 9.5%, downloads 3.2% and sync 2.2%. If you break down streaming into premium and ad-funded, the former generates 48.9% of total revenues, the latter 18.5%.

At the launch of the report this morning, label representatives discussed the disparity in income between premium streaming and the ad-funded services, which include both the free tiers of Spotify et al, and the social media platforms that allow users to put music in their videos.

Although no one was keen to discuss specific ad-funded platforms - TikTok obviously being the elephant in the room at the moment, given its beef with Universal Music - there was a general narrative that the music industry needs to get more value out of the various free services.

Using free to upsell premium subscriptions has long been a priority for the record industry. That has worked better in some markets than others, and in some countries - including some big European markets - there are many more free subscribers than premium subscribers, which means less income overall. So, getting more value out of the ad-funded services might involve finding ways to ramp up the premium upsell in those countries where free still dominates.

Though it could also involve changing the free model to offer consumers other ways to spend money beyond a 10.99 a month subscription. Sony Music's Dennis Kooker honed in on this in particular, suggesting there needs to be more focus on evolving free as well as premium.

That would likely mean "free tiers that are not completely free", he said, "more of a hybrid tier". The potential in that domain may increase as streaming services find ways to take small and one-off payments through their apps without having to hand 30% over to Apple or Google as a result of their respective rules on in-app payments.

You can download the basic version of the Global Music Report here.

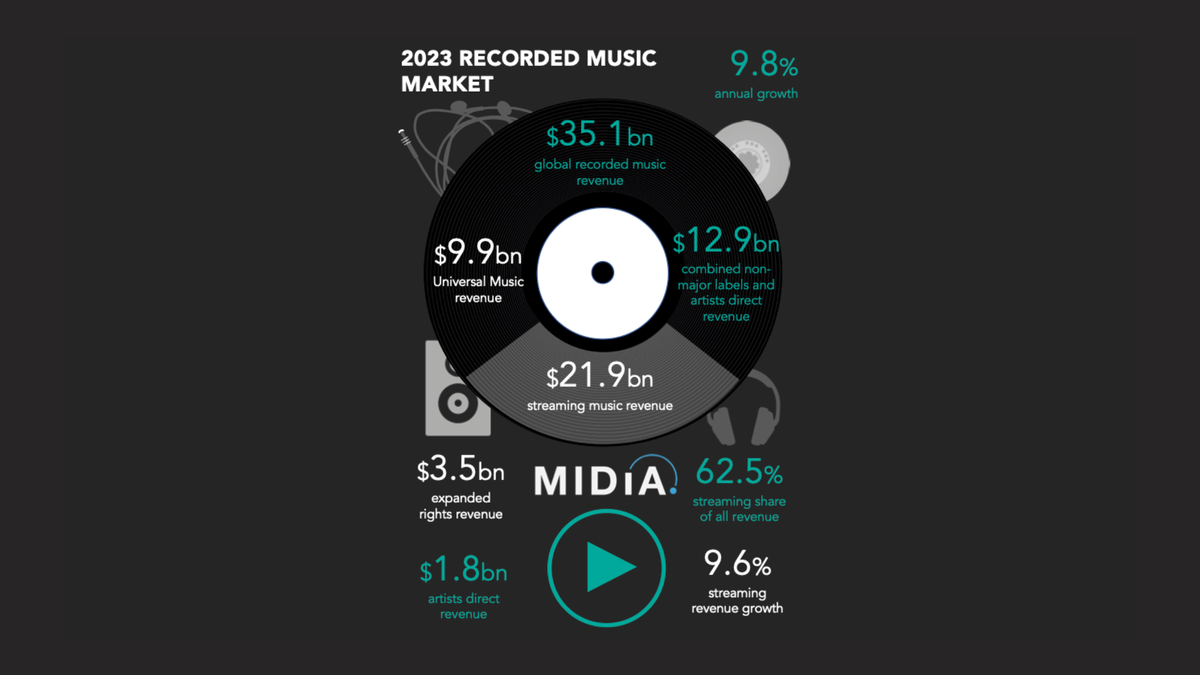

We'll be further crunching the IFPI data - and comparing it to the stats published by other organisations, including consultancy MIDiA - tomorrow. And to get a better understanding of how the different data sets published by different music industry organisations compare and contrast, check out our recent reports on the ins and outs of industry data below...

While IFPI's Global Music Report provides plenty of useful stats and a fair few charts, it is also a lobbying tool for the global record industry. Needless to say, that prompted some AI chat during this morning's launch. The report itself also talks a little about piracy and streaming fraud.

Offering a quick summary of the IFPI's lobbying priorities right now, the organisation's Chief Legal Officer Lauri Rechardt said this morning, “The sustained growth of the recorded music market is encouraging, but it’s also right for us to acknowledge the challenges the industry faces, including streaming fraud, digital piracy in all its forms and, of course, the threat from the abuse of generative artificial intelligence if it is not developed responsibly and with respect for artists’ and labels’ rights".

“Music fans greatly value authenticity and our industry has a strong track record of licensing music and supporting the development of new services that create these experiences for fans”, he went on. “That said, we still need effective tools and the support of authorities to tackle unauthorised uses and to ensure the music ecosystem remains one that is sustainable for the long-term".