French music company Believe - long referred to by many as the “mini major” - is delisting from the Euronext Paris stock exchange and going private in a deal worth nearly €1.5 billion.

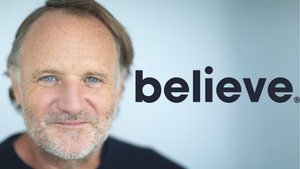

In a statement today announcing the move - which was first rumoured to be happening in early January - Believe CEO Denis Ladegaillerie said “Believe has a significant opportunity ahead to consolidate the independent music market and create the first global major independent, at the service of artists at all stages of their career”.

Spearheaded by Ladegaillerie - the founder and CEO of the business - the delisting sees him join forces with long-time shareholder TCV and private equity giant EQT to form a consortium that will acquire 100% of the share capital of the company.

TCV - a prominent venture capital firm based in Menlo Park, California - made early investments in a range of successful Silicon Valley companies, including Airbnb, Facebook and Netflix, as well as holding stakes in Spotify, ByteDance and SeatGeek. EQT, based in Stockholm, counts Epidemic Sound, UTA and Pioneer amongst its music-related portfolio, as well as holding stakes in clothing market place Vinted and visual content distributors Freepik.

The Believe deal highlights the difficulties the business has faced as a listed company since its Initial Public Offering in June 2021. With an IPO price of €19.50 a share - which valued the company at €1.9 billion and raised €300 million in cash - Believe’s share price has subsequently struggled, falling as low as €7.49 on 30 Jun 2022, just over a year after listing, despite strong revenues and growth.

Ladegaillerie acknowledged this in his statement saying, “Since being a public company, Believe has systematically outperformed its objectives, delivering its IPO plan two years ahead of schedule. However the strength of its operational performance has not been reflected in the share price evolution”.

That IPO took place in the midst of COVID and during a wave of optimism surrounding digital media revenues, and so it was no surprise to many that the share price fell steeply as the world unlocked. Over the same period - June 2021 to June 2022 - Spotify’s share price dropped from around $250 to hit $92.06 on 30 Jun 2022, while Netflix went from around $500 a share in June 2021 to just $170 by 30 Jun 2022.

For a growing business like Believe, a stagnating share price can cause significant issues. During and after COVID in the “ZIRP” era - when companies could raise easy money at zero percent interest rates - this was not such an issue, but as the world adjusts and interest rates are soaring, flat share performance can make it harder, more costly, and slower to raise money.

That said, the company reported cash on hand of €210 million in its half year accounts to 30 Jun 2023, a strong position that allowed it to move fast to acquire UK publisher Sentric Music from Utopia for €47 million in an all-cash deal. That same filing showed that the company had just €35.2 million in current and long-term debt (excluding trade payables and other contractual liabilities).

Compared to Universal Music - which reported €463 million in cash at the end of the same period, with six month revenues of €5.15 billion and debt of €2.3 billion - it shows how well placed Believe might be to grow rapidly under private ownership with significant private equity capital to facilitate deals.

Rumours of plans to take the company private first emerged around the start of 2024, which saw the share price surge from €9.74 to today’s €12.40 - an increase of more than 27% in just a month.

The news that the consortium will be offering €15 a share - another 21% over today’s share price and 54% over that ‘pre-rumour’ price - shows the confidence that Ladegaillerie and his partners have in the future performance of the company.

The most recent financial information shared by Believe - for Q3 2023 - shows that the business brought in revenues of €215 million between 1 Jun and 30 Sep, and €630.4 million for the first three quarters of 2023.

92% of that revenue came from digital, and while only 8% of Believe’s revenues for the first nine months of 2023 was from non-digital sales, that revenue segment - amounting to over €50 million in revenue - had grown by 35% compared to the same period in 2022.

With Believe long referred to as “the mini major”, the confidence of Ladegaillerie and his private equity partners is reflected in the offer price, a huge mark-up over the company’s share price at the point the deal was first being discussed.

While some of that mark up may have been necessitated after rumours of the deal broke and pushed the share price up, nevertheless the consortium must see significant upside in coming years. The company had previously told investors that it was targeting organic compound annual growth of +22% to +25% for the period 2021 to 2025.

Private ownership will let the company do more deals faster - and deals that may have a slightly higher risk profile than would be accepted by a publicly traded company - with the result that its annual growth rate could increase substantially with the leverage the delisting could bring.

If the company’s share price performance had more closely tracked its organic growth - which was 29.9% in 2021 and 32.3% in 2022 - then the company’s valuation might be more like €3 billion today.

Universal Music is currently worth just shy of €50 billion on revenues expected to be well in excess of €10 billion for 2023 (we’ll know at the end of this month). On current performance it’s easy to see how UMG might hit more than €12 billion in revenues for the last year. However, even on €10 billion revenues against a €50 billion valuation, this means that Universal is worth around five times its revenues - but with a substantial debt-overhead priced in by the market.

A large part of that valuation - and Universal’s revenues - comes from the major’s ownership of significant recording and publishing catalogues, while Believe has traditionally been more focused on distribution and services. While some might argue that Universal’s dominant position in catalogue ownership gives it a significant advantage, it’s also reliant on signing and developing new deals to maintain that position - something which requires significant investment, and has a level of risk.

It’s easy to see why Believe’s business model is appealing to TCV and EQT - which have both traditionally focused on investments in high-growth potential technology companies. If Believe’s edge is in delivering a service-driven business underpinned by technology which allows it to do a different type of deal, then this aligns with both funds’ objectives - but also opens the door to the potential of investing in either catalogue or new signings and applying that service and technology edge to delivering significant growth.

TCV’s John Doran says “Believe is strongly positioned as the partner of choice for independent artists and labels globally, as well as for artists and labels that have a digital-first mindset. We at TCV, see Believe’s focus on local content, coupled with its full stack offering addressing all artist segments and focusing on digital artist development over the long term, as highly differentiated, making them a strategic partner for digital streaming platforms globally”.

If Believe was valued on a similar multiple to UMG - and with a much lower debt ratio than the major - it’s easy to see how the true value of Believe’s business could be nearly €5 billion today.

Unfettered by the constraints of being a publicly traded company, if Believe can take its current 30% CAGR and amplify that through well-timed acquisitions that allow it to apply its well-tested growth playbook to increasing revenues and margins, it’s easy to see how - with the five to seven year horizon favoured by many private equity firms - the company might be worth €30 billion or more by 2030.

EQT’s Nicolas Brugère confirmed that acquisitions will form a key part of the onward strategy for the business, saying “Believe’s track record in developing labels and artists worldwide is exceptional. With the music market growth and digitalisation, Believe has significant potential to continue thriving, through organic expansion and strategic acquisitions”.

If Believe’s established playbook combined with funds to drive a pipeline of strong acquisitions can drive significant growth for Believe - and the sorts of returns undoubtedly hoped for by TCV and EQT - it could represent an interesting few years as Believe steps up and engages in aggressive competition to grow its business and market share around the world.